Excel checkbook register formula calculates the running balance and totals the bank accounts, checking accounts, credit card accounts and savings accounts in. Download a FREE checkbook register spreadsheet to record withdrawals and deposits. Note: All Practical Spreadsheets work with Microsoft Excel. See an example of this checkbook here as a shared Google Sheet. This spreadsheet is configured so that anyone can view it but not edit it. You know have a simple, useful check register that you can access from anywhere that you have a web connection as Google Sheets and Apple Numbers can be used on mobile devices as well as laptops and desktops. Free Excel Spreadsheet For Mac Checkbook Register App. By Juliana Lawson on October 24 2018 08:38:48. An accountant needs to not only ensure the financial records are accurate but also retrieve any part of the accounting records to answer accounting questions on the accounts, provide a legal basis for the transactions and report the financial statements at regular periodic intervals.

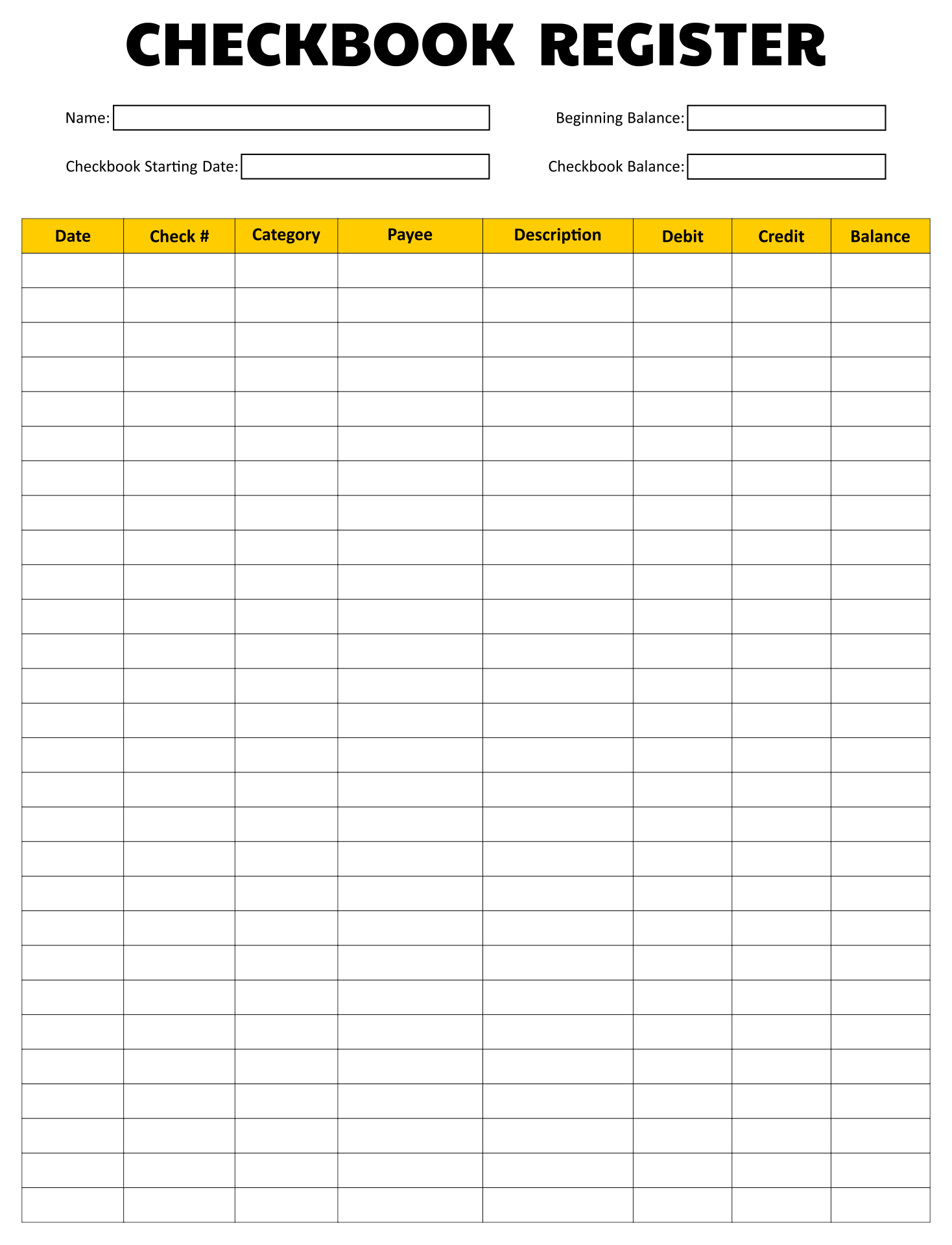

Posted in category Maintaining a Checkbook Register is crucial for staying on top of your financial well-being and re-assuring yourself with up-to-date information of your spending. It also keeps a check on your extra spending habits, as you are forced to look at where the money is going and how much you are left with. Also, there can be those rare events when bank commits mistakes, you can identify them and get them corrected. Lastly, you can also prevent the events of bounced checks and unnecessary fees charged on your account. How to use Checkbook Register First of all you can define type of transactions with their actual definitions in the first sheet of this template.

You can add more transaction types as and when you discover new ones. Thereafter you can use the second sheet named 'Register' to record the Account number, dates between which the records are maintained and opening and closing bank and cash balances. Then under the transactions table, in the first row specify the 'Balance Carried Forward' if any or otherwise enter '0' and start recording transactions as when a deposit or withdrawal happens. In case you are issuing a check or receiving deposit by check then your transaction may not appear immediately on your bank account as a debit or credit hence you need to wait till it reflects and then you can mark your transactions as reconciled in this sheet by writing 'r' or 'R' against it.

Till you mark them as Reconciled, you transaction will appear as 'Outstanding' in Reconciliation Data. On the top of sheet you can watch the Summary where it shows beginning balance, total deposits and withdrawals and end balance. It also reflects the amount to reconcile, current check book balance and final difference, if any.

Checkbook Register Spreadsheet Template For Mac Word

For clear indication of financial state, the checkbook register clearly show a message in green - THE CHECKBOOK IS BALANCED when everything is balanced or message in red appears that says - CHECK BANK CLOSING BALANCE, if a incorrect entry is done or some other mistake is done while recording. We recommend you to record transactions as early as possible in this sheet, if not daily, to avoid any mistakes, saving you hours of effort in identifying the missed transactions. In case you are managing multiple account, you can create copies of this sheet. Also remember not to delete formulas that is contained in 'Balance' column, 'Reconciliation Data' section and 'Summary' section.

Once you become more familiar with the template you can simply protect these columns from unnecessary changes using Excel's Protect Sheet option. Add more rows Adding additional rows can be little tricky as most formulas which calculate totals have to expand correctly to accommodate new rows that you will add. Watch this short video to learn how to do it to avoid possible complications.

Type the following values in cells A1 through A7. • Date - The date you made the deposit, wrote the check, etc. Note that this date does not always correspond to the date on which the transaction is posted to your bank account. This time lag creates the need to reconcile the account monthly. See how to do that in this post. • Check Number - This field is perhaps a bit outdated.

15 years ago, most payments coming out of a checking account would have been from paper checks. Presently, many are ACH's or payments made directly from a bank's website.

0 kommentar(er)

0 kommentar(er)